Lc Discounting Letter Format

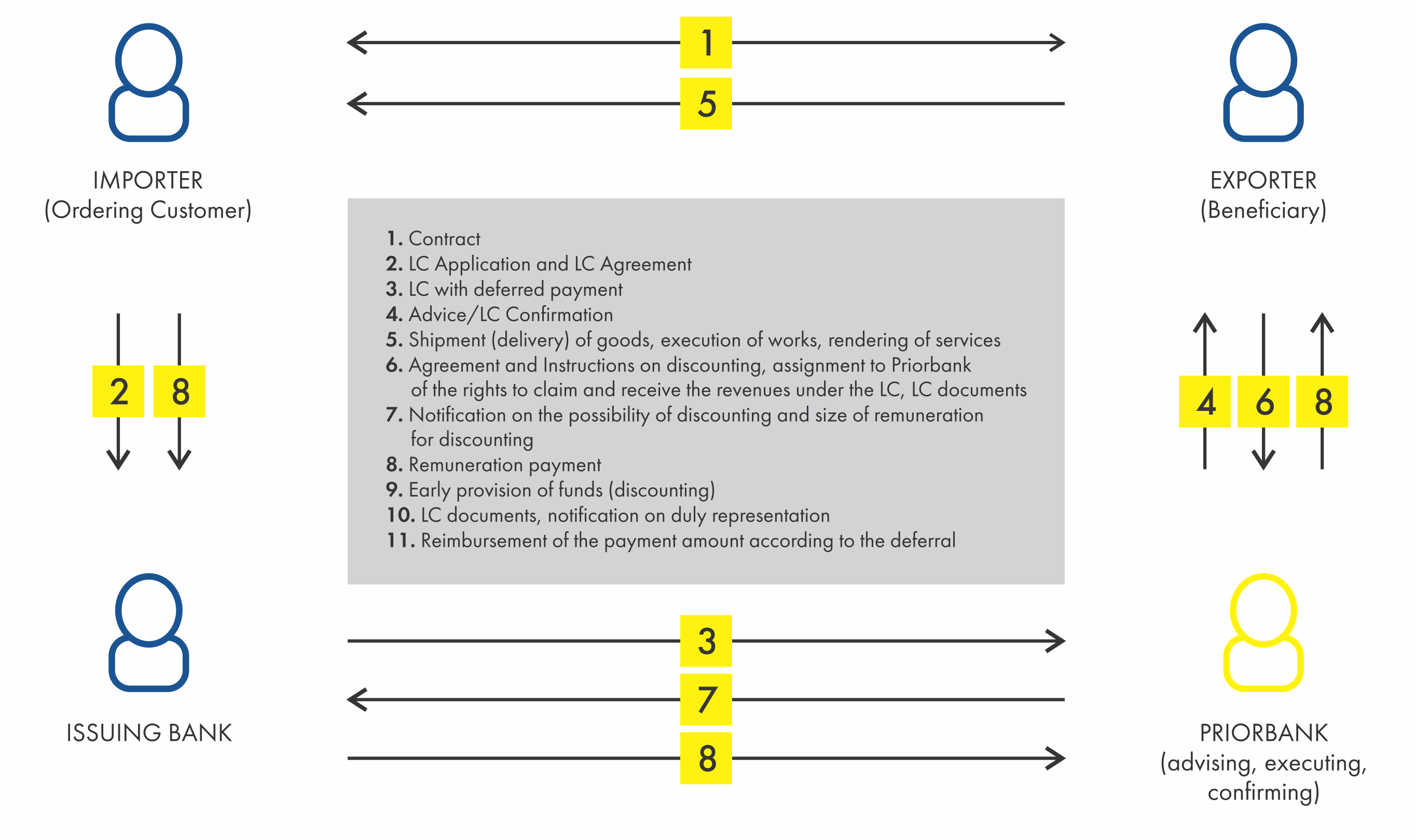

Letter of Credit Discounting Process. In case of bill discounting facility the seller gets the bill discounted immediately it shows and submit the required documents to its bank.

Discounting Of Deferred Payment Obligation On Letter Of Credit

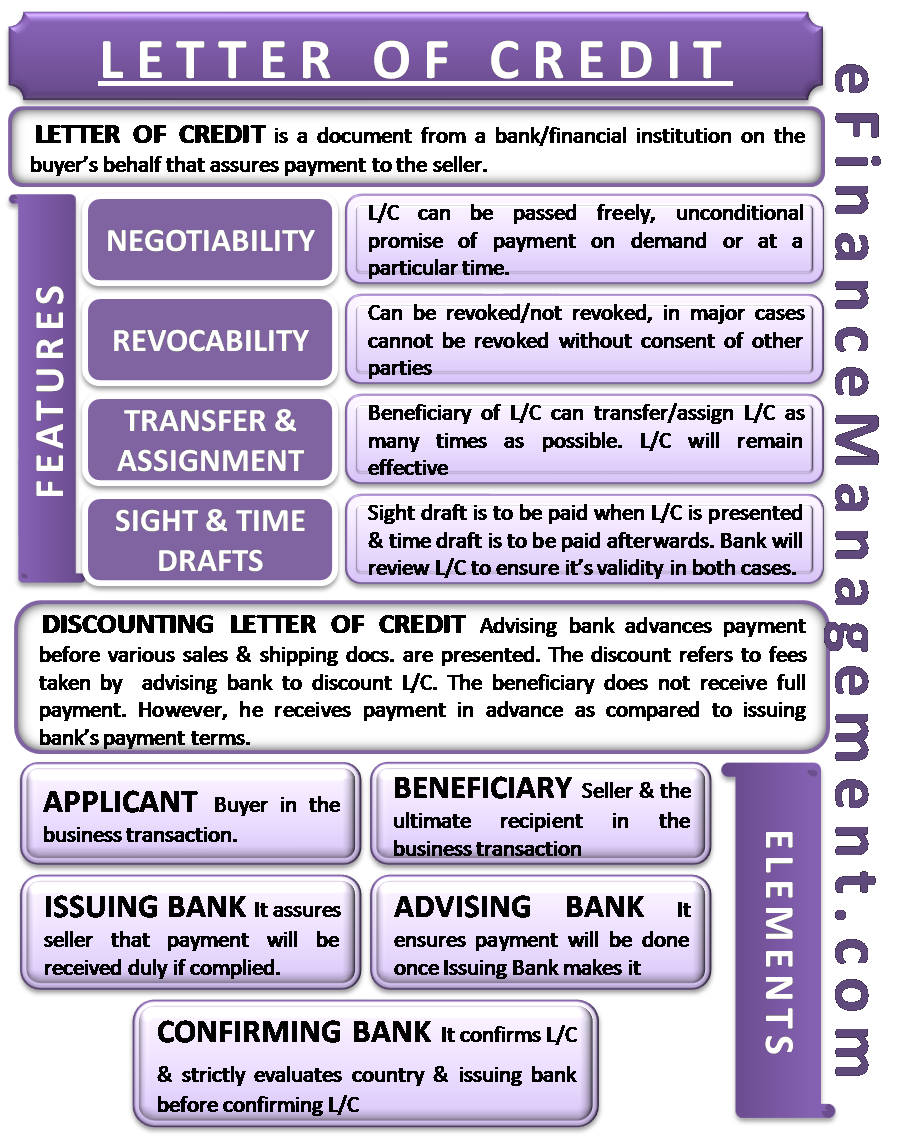

Letter of credit discounting is related to the letters of credit which are available with deferred payment acceptance or negotiation.

Lc Discounting Letter Format. You can use LC Discounting if you sell on credit terms using letters of credit as a means of settlement. A letter of credit can be discounted. Letter of Credit discounting is a short-term credit facility wherein a bank purchases exporters bill and in return make the payment against a securityLette.

To be identified on LC Discounting Funding Certificate. Posted on August 29 2014 by numerouno080. Awarded with CDCS Certified Documentary Credit Specialist two times between 2010-2013 and 2013-2016.

I have a bachelors degree in business administration and masters degree in international trade and finance. LC discounting is a short- term credit facility provided by the bank to the seller. To be identified on LC Discounting Funding Certificate.

LC acts as a guarantee to the seller. Export LC Discounting Exports Letter of Credit Discounting is actually a short-term credit facility offered by the banks to the clients. Letter of credit.

Procedure of LC Discounting or Letter of Credit Discounting. Letter of Credit discounting is a primary method of financing in international trade and is also known as a documentary credit. But intimation needs to send to the buyer through its buyers bank as the transaction is backed with Letter of Credit.

Interest for the usance period actual postage and handling charges will also be collected. The sellers bank would require certain official documents before approval. This field further qualifies the documentary credit amount.

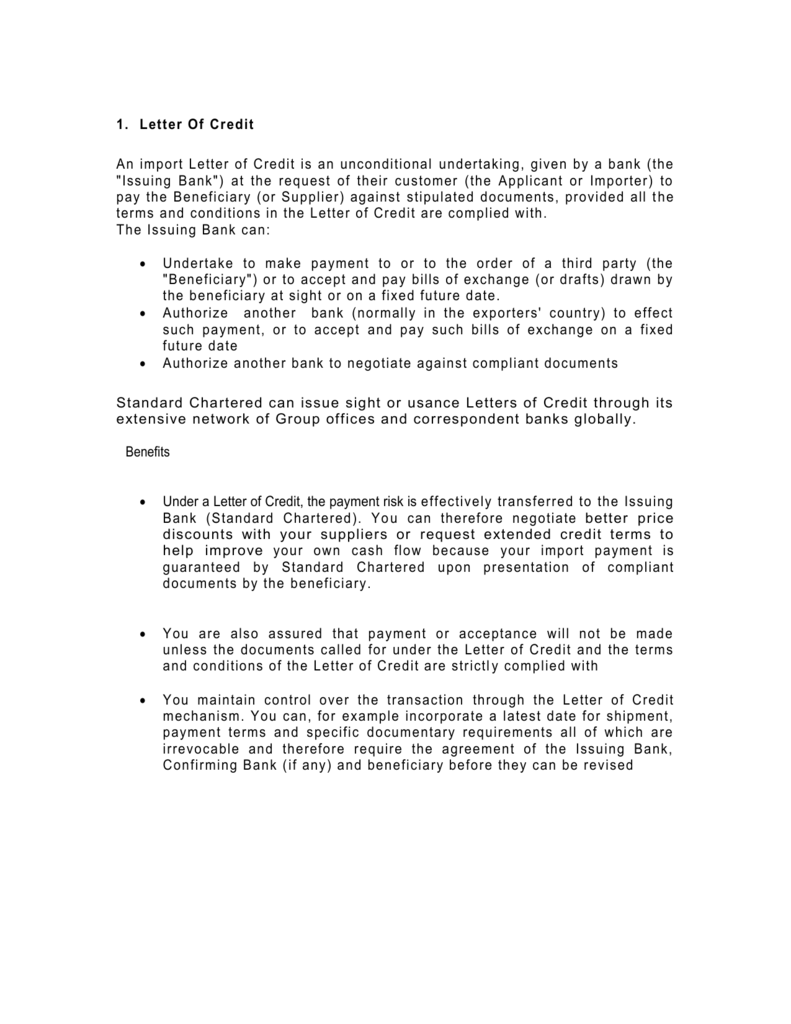

A letter of credit LC is a financial document wherein banks act as an intermediary between a buyer and a seller to ensure the fulfillment of the transaction. Letter of Credit discounting serves as financial security for businesses involved in either export or import or both. The positive tolerance is the percentage that should be added to the LC amount to arrive at the Maximum LC Amount.

So in the case of default by the buyer the bank will clear the dues of the seller. The negative tolerance is the percentage that should be subtracted from the LC amount to arrive at the Minimum LC Amount. Discounting of Domestic Sales Purchase Export Sales Bills Under Letter of Credit.

LETTER OF CREDIT DISCOUNTING AGREEMENT. The bills should be got accepted by the drawee through their bankers. While getting an LC discounted the supplier or holde of LC should verify whether the issuing bank is on the approved list of banks with the discounting bank.

The Letter from the prime banks or monetary establishments is taken into account as a whole security. LC Vs Buyers Credit Buyer opens the letter of credit usance in favour of seller. Beneficiary is to submit separate Debit Note.

At sight letters of credit should not require any discount mechanism as issuing banks or confirming banks must honor at sight credits as soon as they determine that beneficiarys presentation is complying. In this case LC issuing bank confirms all the original documents and provide acceptance to the confirming bank. Fundamentally it is a guarantee provided by a financial institution to pay sellers on behalf of buyers in case of default on their part.

Acceptance of letter of credit from the issuing bank. Sight LC - Format. LC discounting allows you to receive funds as soon as there is a binding commitment from your buyers bank that payment is due on a specific.

Domestic LC discounting Domestic Inland Letter of Credit Discounting is actually a short-term post shipment credit facility offered by the banks to the clients. The buyer asks his bank to issue a letter of credit to the seller or the beneficiary. A receiver can give the LC to the investor and acquire the loan sanctioned.

Delivery notes bills of lading shipment documents etc. The sellers bank verifies the LC before he ships the goods. In this process the banks or NBFCs purchases all the documents or bills produced by the client and which are backed by LCs and pay the money to the client against discounting interest for the usance period as per the.

The loan quantity is also up to hundred percent of the LC price. The facility will be extended for both domestic and export transactions under Letters of Credit opened by First Class banks. 50Pct of Lc Discounting and negotiation charge or Discounting and Negotiation charge at the rate 725 pct PA whichever is lower will be borne by the applicant and the balance to be borne by the beneficiary.

Once the LC is approved the discounting bank releases the funds after charging a certain amount as premium. Name of the Bank Name of the Branch Address Sub. However presenting an LC does not qualify for a discounting facility in itself.

_____ The Manager YES Bank Ltd Branch address. Improve your cash flow with DBS letter of credit negotiationdiscounting which allows you immediate credit while you await payment from the issuing bank. Letter of Credit Number.

Since 2009 I am a professional and independent letter of credit consultant from Izmir Turkey. To be identified onLC Discounting Funding Certificate. Bill of exchange and other trade document copies.

My name is Ozgur Eker. Letter of Credit Date. Receipted Challan being proof of delivery of goods Documents of title to goods evidencing despatch of goods RR LR shipping documents Any other relevant documents.

Dear SirMadam Our company is maintaining a current account in your bank at branch bearing account number. Letter of Credit discounting is a. Discounting of documents under LC no.

Indicative format of the request letter to be received from the buyerseller for LCBD discounting On the letterhead of the customer To Date. Request Letter for Amendment of Letter of Credit Import inland for Raw material. Letter of credit discounting process initiates when the buyer on the request of the seller obtains an LC from a financial institution before the goods are shipped to him.

In this process the banks or NBFCs purchases all the documents or bills produced by the client and which are backed by LCs and pay the money to the client against discounting interest for the usance period as per the terms of LC.

Professional Singer Invoice Discounting Agreement Template With Regard To Invoice Discounting Agreement Templ Professional Templates Templates Invoice Template

Special Discount Offer Template Sample Letter To Client Of 10 Special Discount Offer Discount Offer Lettering Offer

Various Letter Lcbd Pdf Invoice Government

Letter Of Indemnity Format For Bank Seputar Bank

Invoice Discounting Agreement Template Business Template Ideas In Invoice Discounting Agreement Template Business Template Invoice Template Reference Letter

Invoice Discounting Agreement Template Invoice Template With Invoice Discounting Agreement Template Invoice Template Templates Invoicing

Request Letter To Bank For Lc Backed Bill Invoice Discounting

14 Sblc Format Uns Pdf Letter Of Credit Banks

Example Loc Pdf Letter Of Credit Banking

1 Letter Of Credit Standard Chartered Bank

Letter Of Credit Definition Features Elements Discounting More Efm

Inland Letter Of Credit Accounting Education Financial Management Business Money

What Is Letter Of Credit Types Characteristics Importance

Standby Letter Of Credit Provider Who Is A Standby Letter Of Credit Provider By Grandcityinvestmentlimited Issuu

Request Letter To Bank For Lc Backed Bill Invoice Discounting

Standby Letter Of Credit Definition Issuance Notification And Uses By Grandcityinvestmentlimited Issuu

Letter Of Credit Format For Shipment By Sea Air 041006 Pdf

Best Letter Format Example - Lc Discounting Letter Format

business Letter Format and Example

There are many vary types of situation letters you might use in your professional career. From lid letters to letters of recommendation, drafting a clean, readable issue letter can back you communicate ideas clearly. There are several steps you can allow to create a matter letter professional and capture for the audience of your letter.

Business sections of a issue letter

A properly formatted thing letter should have the afterward sections:

Your get into information

The date

Recipients open information

Opening salutation

Body

Closing salutation

Your signature

1. Your right of entry information

On the left-hand side of your concern letter, you should list your right to use info:

First pronounce Last name

Address

City, welcome Zip Code

Phone

2. The date

Add a space after your admission counsel and later mount up the date of your letter:

Month, hours of daylight Year

3. Recipients gain access to information

Add a expose after the date of the business letter and next accumulate the recipients read information:

First publicize Last name

Address

City, give access Zip Code

Phone

4. commencement salutation

Add a melody after the recipients retrieve opinion and then pick a recognition to right to use your issue letter. Common foundation concern letter salutations include:

Dear [First pronounce Last name],

Dear [Ms., Mrs. or Mr. Last name],

Dear [First name], (only use if you know the recipient)

To Whom It May thing (only use if you cannot find a specific contacts name)

Read more: Writing response for Letters: Tips and Examples

5. Body

The body of a issue letter is where you appearance the wish of your communication and is typically no longer than three to four paragraphs.

Paragraph 1: Opening

Paragraph 2: The argument

Paragraph 3: Closing

6. Closing salutation

Add a broadcast after the body of the letter and later pick a reply to close your situation letter. Common closing event letter salutations include:

Respectfully yours,

Respectfully,

Cordially,

Sincerely,

Yours sincerely,

Thank you,

Related: How To Write a concern Letter confession (With Tips and Examples)

7. Signature

Add two lines and sign your full name. The taking into consideration line, print your first and last name.

Signature

First post Last name

How to format a issue letter

When formatting your thing letter, readability should be your summit priority. From selecting a font style to correcting margins, you should make positive your letter is clean, positive and severely readable. There are a few oscillate things to think not quite subsequently formatting your event letter:

1. pick a professional font size and style

When deciding on which font to choose for your thing letter, you should pay attention to cleanliness and readability. even though it may seem tempting to choose a stylistic font that personalized the letter, it might be difficult for your audience to read. They should be competent to acquire the instruction they compulsion from your letter as speedily as possible.

Here are a few examples of well-liked fonts used in professional documents:

Arial

Avenir

Calibri

Corbel

Garamond

Georgia

Gill Sans

Helvetica

Open Sans

Roboto

Times further Roman

When selecting a font size, you should declare the smallest size in which your document will yet be easily readable. You should stay together with 10 and 12 points for your font. Smaller than 10 narrowing fonts will be hard to read, while fonts larger than 12 points might appear unprofessional.

2. count sections for all indispensable information

When designing the layout for your business letter, keep in mind all of the necessary suggestion typically included on a professional document. Typically, a concern letter includes the like information at the top:

Your log on information (Name, job title, company, address, phone number, email)

The date

Recipients get into counsel (Name, job title, company, company address)

This assistance is followed by a tribute and then the body, followed by your close and signature. in imitation of drafting your situation letter, be clear to enhance all appropriate information.

Read more: The 7 Parts of a event Letter

3. Pay attention to spacing and margins

Spacing plays an important role in making your issue letter appear readable and professional. Be definite to put spaces amid the elements at the top of your letter (your approach information, the date and their log on information) followed by unorthodox impression to start your letter.

In the body paragraphs, your letter should be single-spaced to create a clean still readable document. You should enhance a manner with each paragraph and previously and after your closing. It is best practice to align your entire letter to the left side of the page as opposed to centered or similar right. This makes it easy to follow for the audience.

Typically, a professional document has one-inch margins. It is take over for margins to be a bit larger than normal (up to one and a quarter inches) for situation letters.

4. begin and stop your letter properly

As you begin your letter, you should house the recipient appropriately. If you realize not know the recipient, it is take possession of to supplement a general nod taking into account To Whom It May Concern or addressing them by their job title such as Dear Director of Finance.

If you know the recipients proclaim but have never formally met them or have by yourself briefly met, you should supplement a more proper reaction like, Dear Mr. (Last Name) or Dear Ms. (Last Name). If you know the recipient, setting free to greet them by their first name.

Select a brief, seize closing as you end your letter in imitation of Sincerely, Respectfully or All the best followed by your first and last post and job title. You should combine a space in the middle of the near and your name.

Comments

Post a Comment